Series: The TurboTax Trap: How the Tax Prep Industry Makes You Pay

ProPublica has long detailed how Intuit, the maker of TurboTax, and other companies have worked against making tax preparation easier and less costly.

The Federal Trade Commission has ordered the maker of TurboTax to stop what it called years of widespread deceptive advertising for “free” tax-filing software.

The order, released Monday, was accompanied by a 93-page opinion that harshly criticized Intuit, the Silicon Valley company behind TurboTax. Intuit’s “deceptive ad campaign has been sufficiently broad, enduring, and willful to support the need for a cease-and-desist order,” the commission’s opinion stated.

The order caps off a process that started four years ago when the FTC launched an investigation in response to a series of ProPublica stories documenting Intuit’s ad tactics. ProPublica revealed how millions of Americans were lured into paid tax preparation products even though they were eligible to file for free through a government-sponsored program. Huge sums of money are at stake: In a single year, tax prep companies led by Intuit generated $1 billion in revenue from customers who should have been able to file for free, according to one analysis.

In a statement, Intuit said it planned to appeal the order in federal court. “There is no monetary penalty in the FTC’s order, and Intuit expects no significant impact to its business,” the statement said, adding that the company “has always been clear, fair, and transparent with its customers.”

Sam Levine, the director of the FTC’s Bureau of Consumer Protection, said in a statement that the order was intended to send a message to all companies: “‘free’ means free — not ‘free for a few’ or ‘free for some.’ Businesses can expect an FTC enforcement action if they harness the power of ‘free’ in the dishonest way Intuit did.”

Apparently in anticipation of the FTC’s order, Intuit recently changed how it touts “free” tax prep.

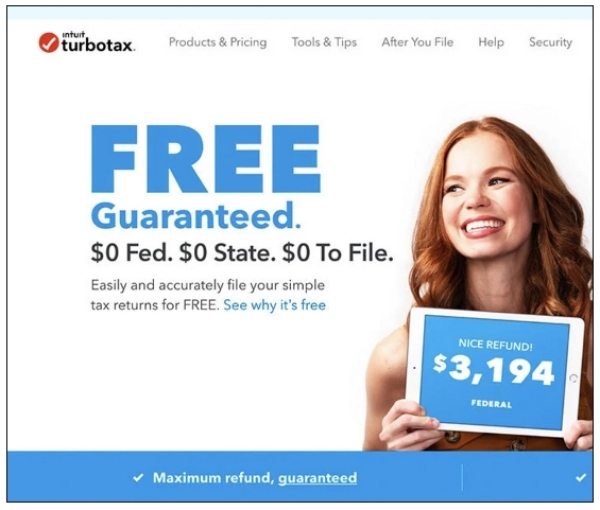

Here, for example, is how Intuit’s ads used to look. This is taken from Intuit’s website in 2019:

Ads in that period simply stated the product was “FREE Guaranteed.” Other ads took this message even further. The company’s “free, free, free” TV ad campaign featured scenes of people just saying the word “free” for 30 seconds. Intuit pulled its “free, free, free” ads in 2022, after the FTC and all 50 state attorneys general began investigating Intuit’s advertising, but the company continued to tout free tax prep.

Of course, for most customers, TurboTax wasn’t free. A list of conditions (like having student loan interest or unemployment benefits) would disqualify customers from the free offering and force them to pay, often over $100, to have their tax returns filed. People often found this out only after having entered much of their tax information and did not want to start the process over again.

Today, TurboTax ads state that only about 37% of taxpayers will qualify:

The FTC order requires clear disclosures in the company’s ads. TurboTax must inform consumers that most filers won’t qualify.

When ads have the space, Intuit is also required to provide full details of who qualifies to file for free. On the TurboTax website, a link details what “Form 1040 & limited credits only” means: Filers with student loan interest do now qualify, for example, but those with unemployment income do not.

The FTC’s order also has a more general requirement, prohibiting TurboTax from “misrepresenting any material fact.” This “ensures that Intuit does not make other false claims about Intuit’s products to consumers,” the FTC wrote in its opinion.

The fact that Intuit has changed its advertising doesn’t mean it agrees with the FTC. The company raised a host of objections during the process. Intuit argued that forcing the company to tell consumers that its product is not free for a majority of taxpayers would violate the company’s First Amendment right to free speech. It also protested that having to disclose the terms of who would qualify would lead consumers to suffer from “information overload.”

The FTC swept those arguments aside in its opinion, as it did Intuit’s complaint that it was unfair to prevent TurboTax from touting “free” tax prep when its competitors continued to do so. “Courts have long held that it is not defense to an order against unlawful practices that others in a marketplace are similarly engaging in unlawful practices,” the commission wrote.

Not having succeeded at the FTC, Intuit plans to take its arguments to a federal appeals court. Derrick Plummer, a company spokesperson, criticized the FTC as “biased” and said, “we believe that when the matter ultimately returns to a neutral body Intuit will prevail.”